CareVest Core Mortgage Investment Corporation

CareVest Core Mortgage Investment Corporation ("CareVest Core MIC") provides investors with the opportunity to passively invest in commercial mortgages. Generating a historical compounded annual yield over 8.5%* while currently holding 100% first mortgages, CareVest Core MIC targets a diverse range of opportunities from commercial to residential real estate, including raw land, multi-family, infills, office, industrial, and retail. CareVest Core MIC has successfully delivered attractive returns to investors since its inception in 2021.

*The historical compound annual yield for Class A Shares of CareVest Core MIC at June 30, 2025 and the most current month exceeds 8.50% and is net of all fees and expenses, unaudited and prepared by CareVest Management Corp. Annual compound yield is calculated as the (ending value/beginning value)^(12/number of months)-1 with the assumption that dividend reinvestment is compounded at Net Asset Value per Class A Share. Past performance may not be repeated and there are no guarantees of future performance. Visit www.carevestmanagement.com for complete details of the most recent performance of CareVest Core MIC, including simple yield and yield since inception, which differ from the annual compound yield.

Investment Objectives

The investment objectives of a MIC are to preserve investor capital and generate a return that pays distributions. They are also an opportunity to own shares in a tax-efficient fund that invests in real mortgages on real property.

Fund Highlights and Resources

More details on CareVest Core MIC can be found through the below links:

Historical Fund Performance

100%

PRIMARY

MORTGAGES

(1)

Secured by a first mortgage lien on real property. A high percentage of primary mortgages in the portfolio ensures the lender is in priority position.

10.3%

GROSS

WEIGHTED

AVERAGE

(1)(2)

With the majority of mortgages yielding upwards of 9% interest per annum, before deductions of fees and expenses. Net yield to investors will differ.

64%

LOAN TO VALUE

RATIO

(1)(3)

With a loan-to-value ratio of 75% or lower for most mortgages, the CareVest Core MIC is constructed to maximize risk-adjusted returns.

(1)(4)(5)

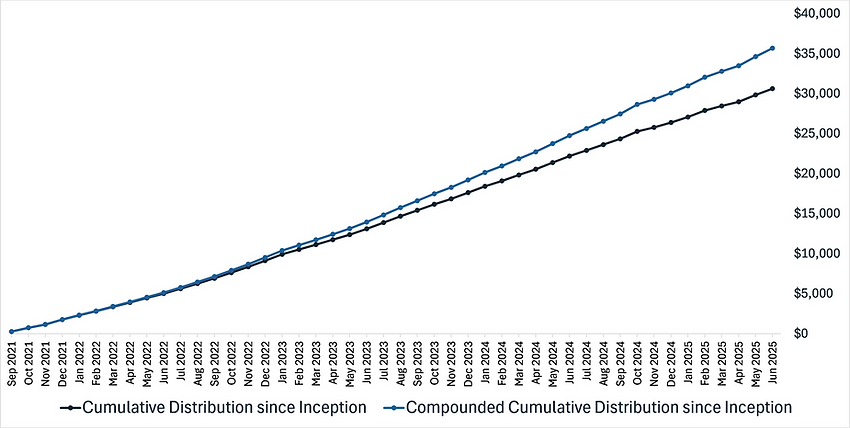

Historical Dividend Distributions Since Inception (for $100,000 invested)

(1) At June 30, 2025. (2) Gross weighted average loan interest rate per annum charged by CareVest Core MIC to borrowers before the deduction of fees and expenses. The gross weighted average loan interest rate per annum many differ from the net yield to investors as a result. Finance income (Loan Interest Rate) is recognized when it is probable that the economic benefits will flow to CareVest Core MIC and the amount of revenue can be measured reliably. Where a Mortgage is not in good standing, the recognition of finance income is dependent on the timing of the receipt of cash flows from the borrower. (3) Weighted average estimated Loan-to-Value ratio at the date the mortgage is acquired or funds are initially committed. (4) There is no assurance that historical performance will be representative of future performance. Future dividends are not guaranteed. Please visit www.carevestmanagment.com for additional information. (5) Inception is based on the initial issuance of Class A Shares in August 2021 and the first distribution in September 2021. Dividend Reinvestment Plan (DRIP) is at Net Asset Value per Class A Share. Source for historical dividends: www.carevestmanagment.com. CareVest Core Mortgage Investment Corporation is only sold through our registered exempt market dealer, CareVest Private Capital Inc. Visit www.carevestprivatecapital.com for more details.

How it Works

CareVest Core MIC is structured as a Mortgage Investment Corporation (“MIC”). Investors purchase shares of CareVest Core MIC – an investment fund which acquires and maintains a portfolio of mortgages. Therefore, a MIC structure provides a tax-efficient opportunity to indirectly participate and passively invest in the real estate lending market.

CareVest

Core MIC

Investor

Portfolio of

Mortgages

Invest

Invest

Dividends

Interest

Payments

Get in Touch

If you are interested in placing an investment or would like to learn more from a registered dealer, please contact us. Available in British Columbia and Alberta.

©2025 by CareVest Group

Investment Fund Manager and Restricted Portfolio Manager

Exempt Market Dealer

Investment Sales

1 (877) 847-6797

Investor Relations

1 (855) 278-3611

Vancouver Office

Suite 1150, 510 Burrard St.

Vancouver, BC V6C 3A8

Mortgage Broker: (604) 632-9919

Calgary Office

Suite 1450, 555 4th Ave SW

Calgary, AB T2P 3E7

Mortgage Broker: (403) 509-0115

Fund Manager: (403) 648-3613

Exempt Market Dealer: (403) 538-5837

Disclaimer

This website is for information purposes only and the information contained herein is not an offer to sell or a solicitation of an offer to purchase any security. Any offerings of securities will be conducted by a registered dealer in specified jurisdictions using offering documentation prepared in accordance with applicable law. You should read those offering documents before making any investment decision as they will contain required disclosure regarding the offering terms, risks, conflicts of interest and other disclosure relevant to making an investment decision. Investment opportunities available through CareVest Private Capital Inc., an exempt market dealer registered in Alberta and British Columbia, are only suitable for investors who are qualified to purchase the securities, are familiar with, and have the ability and willingness to accept the high risk associated with private investments. Members of the CareVest Group are related and connected to the issuers referred to herein, as set out in the Relationship Disclosure Information. Vancouver office is shared by CareVest Capital Inc. and CareVest Private Capital Inc. CareVest Management Corp. does not have an office in Vancouver.

Legal & Disclosure

%20(1)%20(1).png)

.png)